The top 100 SaaS companies

in Europe and Israel

The European

Software-as-a-Service world changed forever when Daniel Dines, the founder of UiPath,

made the cover of Forbes as ‘Boss

of the Bots’ last month. Who would have thought five years ago that

a Romanian SaaS company would be valued at $7 billion and reach that valuation in

record time?

It is prime time for European SaaS

companies and the third edition of the Accel Euroscape, the list of the top 100

SaaS companies from Europe and Israel, shows the rising position of Europe on

the global SaaS stage, benchmarks how European SaaS companies compare to their

US counterparts and lays out five predictions for the European SaaS market. Full presentation available here.

Bigger,

stronger, faster: SaaS continues to eat software

First, let’s zoom out and look at how SaaS

companies have performed globally. Ten years ago, in October 2009, Salesforce

was a dominant force among the 21 public SaaS companies, with a valuation that represented

one third of their combined $22 billion market capitalisation. Since then, its

market cap has grown 18x, reaching $130 billion, which is the fourth biggest

for an enterprise software company right behind companies that are 20 years

older, Microsoft, Oracle and Adobe.

Today, the landscape is very different.

There are 66 public SaaS companies, representing a formidable $796 billion

combined market cap, which is 36x bigger than the combined 2009 market cap! The

new generation of public SaaS companies is also growing faster, reaching a $100

million revenue run rate in five to seven years today versus 10 to 15 years a

decade ago.

Source: The Angel VC Blog, BVP

SaaS benchmarking Oct. 2009, CapitalQ, Yahoo! Finance, Market cap as of Oct

2009 and Oct 7, 2019

This public market momentum is continuing

to accelerate with 24 SaaS IPOs in 2018-19 compared to 17 in 2015-17. The

2018-19 cohort were valued at a combined $126 billion in market cap on their

IPO day, which is 4.3x the value of the 2015-17 cohort, and six have crossed

the $10 billion market cap threshold within a year of going public (Dropbox,

Docusign, Crowdstrike, Slack, Datodog and Zoom), while none of the 2015-17

class did.

The

rise of Europe

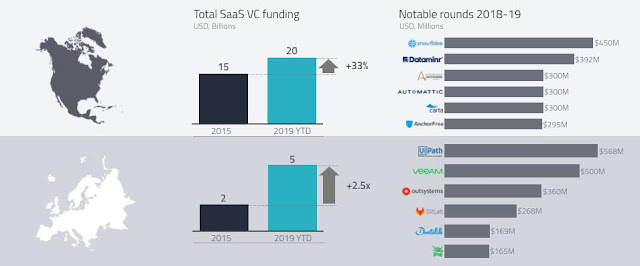

Against this healthy backdrop, let’s drill

down into Europe. Venture investment in the region’s SaaS companies is growing quickly.

From 2016 to 2019, it rose from $2 billion to $5 billion, growing much faster

than in the US, which grew from $15 billion to $20 billion. It now represents

one quarter of the US. European companies have been able to raise rounds as

large as their US counterparts, and UiPath and Veeam top the list with $568

million and $500 million in total investment respectively.

This is mirrored by our own investment. Accel

has invested 3.6x more capital into new European SaaS companies in the past

five years than we did from 2010 to 2014, and our 28 newest investments have

raised 5.3x more capital than those from the previous five years.

Source: TechCrunch, Crunchbase,

PitchBook

Source: Company data, S1

filings, CapitalIQ, Accel analysis, Bessemer Venture Partners

2019

Accel Euroscape: list of top 100 SaaS companies from Europe and Israel

Before diving into the list of top 100 SaaS

companies, we looked back at our 2016

and 2017

editions to assess the companies’ track records. From a financing

standpoint, 29 companies from the list have raised more than $100 million, and the

list has raised a total of $9.6 billion collectively. There has been $4 billion

of realised exits through 17 mergers and acquisitions, with Datorama

(Salesforce, $850 million according to Reuters) and Demisto (Palo Alto

Networks, $560 million according to TechCrunch) as the top two. In addition, the

list generated 11 new unicorns (UiPath, Monday, DarkTrace, Intercom, Doctolib,

JFrog, Celonis, Collibra, Sisense, TalkDesk and WalkMe).Note: to create the list, we ranked each company by a set of criteria including market attractiveness, level of technology differentiation, strength of the team and initial traction (monthly recurring revenues and growth in number of employees). To improve the ranking, we have also worked with G2 to incorporate customer feedback. Nothing is perfect, and we might have missed some great companies. Your feedback is welcome!

The evolution of the list clearly shows the

momentum we continue to see in the market, with key trends including:

·

There are strong players

emerging from a diverse set of industries, from security to HR and marketing.

·

Close to 50% of the companies

in the list are between $10 million - $30 million ARR and 40% have raised $15 million

- $50 million already.

·

Geographically, while the UK

and France remain strong with 24 and 21 companies respectively, Germany has

been the fastest grower, going from eight to 17 companies.

What’s

next?

These are strong upward trends for the

European SaaS industry, but of course the big question is what does it all mean?

When looking at the list, we see five trends that are likely to emerge.

1.

The rise of the bots: “I want a robot

for every person,” Dines told Forbes during his interview. While Robotic Process

Automation and process mining are leading the adoption curve, delivering

unprecedented ROI to the enterprise, the rate of AI adoption is still very much

on the cusp of explosion. With more than 50% of companies across sectors at the

evaluation stage and less than one third considering AI as a mature practice,

we think we are about to see a fast pace of adoption. And yes, we agree with Daniel

that there will be a lot more bots in the enterprise in the near future, as AI

comes of age.

2.

Ubiquitous APIs: with Amazon Web Services

reaching a $34 billion revenue run rate, Stripe and Twilio valued close to or

above $20 billion and the next generation of companies emerging, APIs are now

foundational to the development of cloud computing and their adoption will only

accelerate. We will see a new generation of API companies emerging from Europe,

with companies like MessageBird and Algolia already showing great promise.

3.

Security shifting left: writing code is

good, but writing secure code is much better, and it costs six times less. While

there are so many industry-focused predictions we could make, we are only going

to highlight one in security, an ever increasingly important industry: correcting

security flaws early in the development cycle vs. the operating and monitoring

stages will become mainstream. Currently emerging, with companies such as Snyk

and ShiftLeft, we see this trend as a key tenet for the next generation of

leading security companies.

4.

Market correction: while the momentum is

strong, valuation multiples are way above their median level and more and more

funding is going into the company lifecycle early. There will be a market

correction, and while we don’t know if there will be a hard or soft landing,

our advice to companies is to take advantage of the environment and raise

capital now, while making sure that they have solid control of their cash burn.

5.

European SaaS decacorn: European

companies are getting bigger faster, and we believe Europe will generate the

first SaaS decacorn in less than three years and the first SMB SaaS decacorn in

less than five years.

******************